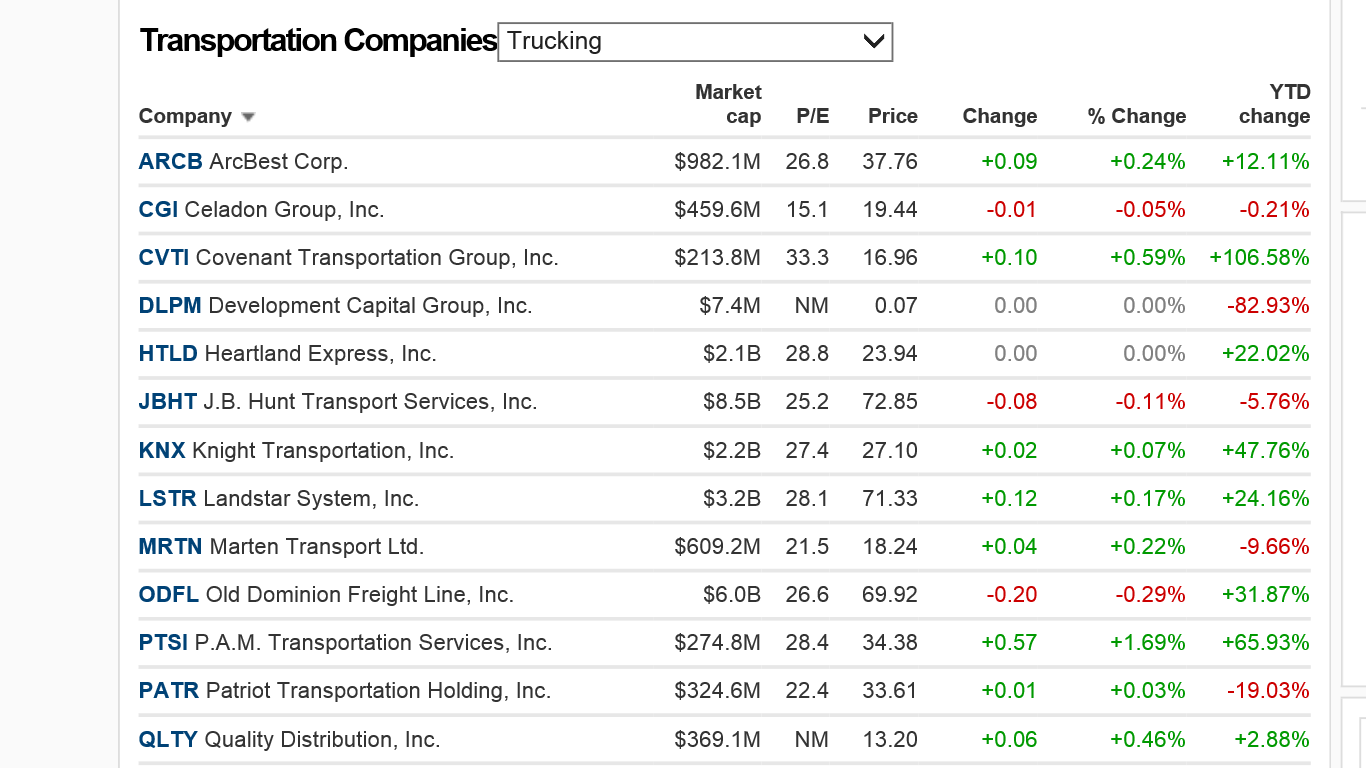

Despite the lack of truck drivers in the trucking industry, transportation stocks have been on a tear in 2014. One of the strongest stocks to date is Old Dominion Freight Line or (ODFL). Old Dominion stocks have been positive over the years but only in small yields.

Sales growth over the last few years has been in the single digits, except for the 2Q of 2014. Sales growth hit 19 percent in Q2. Not only that, earnings growth hit 26 percent, up 13 percent from the previous quarter.

YTD, ODFL is up over 22 percent. Old Dominion stocks also held strong through the market correction of the week before. ODFL is rated as one of the top stocks in its sector. It has a profit margin of 14 percent. It has everything that you want to see in a stock. It scores a 99 on the Composite Rating. The question is, will it continue to grow at blistering levels?

This one is close, I say this is a BUY but pay attention to the volume. If you see volume climbing on Old Dominion stocks, investors are buying. You want to look for 35-40 percent raise to be safe. Volume has been low on the stock, so if you see a sharp climb, you know what’s going on. Old Dominion is certainly a stock you want to keep you eyes on as we edge closer to September.

Old Dominion Freight Line, Inc. operates as a less-than-truckload (LTL) motor carrier in North America. It provides regional, inter-regional, and national LTL services; and other logistics services. ODFL has a PE ratio of 24.6. Currently there are 3 analysts that rate Old Dominion Freight Lines a buy, no analysts rate it a sell, and 7 rate it a hold. (According to the experts at The Street).

Trade-Ideas LLC identified Old Dominion Freight Line as a new lifetime high candidate according to The Street. The average volume for ODFL over the last 30 days has been 457,900. Source: The Street